What Moves the Work Comp Experience Mod?

Demystifying Arguably the Most Important Number in Your Risk Management Efforts

By John Oliver, Manager of Property & Casualty Claims

By John Oliver, Manager of Property & Casualty Claims

Isn’t it surprising how much mystery is wrapped up in the work comp experience mod…especially when you consider just how important those three simple digits are to your organization? In this article I’ll aim to demystify the experience mod a bit by discussing the key inputs and running through some what-if scenarios. If payroll goes up does my mod go up? What if we have one really bad employee injury?

Quick disclaimer: Please note that each state handles work comp slightly differently. In this article we’ll be leaning very heavily on Wisconsin law. If you have employees working in other states some of what is outlined here may not apply. I encourage you to discuss state-specific questions with your trusted insurance advisor.

But first…what is an experience mod?

In Wisconsin, an organization with sufficiently high payrolls and work comp insurance premiums becomes eligible for experience rating. The exact premium level fluctuates from year-to-year but tends to hover right around $7,500. If your premiums are lower than that you may not have an experience mod at all, but for those that do, the experience mod is a single number that essentially identifies how your employee injury record compares to your competitors. You can think of it being a bit like your high school GPA, but instead of test scores it loosely measures your safety record…and unlike your GPA, the lower the number the better!

Each year, work comp insurance carriers take your experience mod and use it as a multiplier to determine your insurance premiums. If your experience is average, your mod will be close to 1.00 and the multiplier will essentially keep your premiums flat. If your experience is great, your mod will be below 1.00 and will therefore reduce your premiums. And, of course, if your employees are getting injured more than expected your mod will be greater than 1.00, and your premiums could be significantly higher than your competitors.

What are the inputs in the experience mod?

At a very high level, the experience mod is snapshot of a three-year period and has two primary components:

- Your ACTUAL work comp claims experience, divided by

- Your EXPECTED work comp claims experience.

In very simplified terms, if you were expected to have $10,000 in work comp claims during the three-year window but instead had $20,000 in claims, your mod would be 2.00 (20,000 ÷ 10,000). That 2.00 means your experience was twice as bad as expected, which at the end of the day means your work comp insurance will be twice as high as an average organization.

Quick note that if you have zero actual claims your mod will never be 0.00. Each organization has a minimum experience mod that is used to calculate work comp premiums.

How are ACTUAL claims calculated?

You might think calculating your actual claims would be straightforward, but there’s more nuance involved than you might expect. Determining actual claims isn’t simply a matter of adding up all the money spent on worker injuries.

As you may be aware, the rating bureaus provide significant incentives for employers to help injured workers return to work as quickly as possible, even if returning requires that they work in modified, lighter duty roles. Any work comp claim that is simply medical in nature – meaning there is no wage reimbursement or disability – receives a 70% reduction before entering the calculation.

Additionally, the impact any single claim can have on the mod is (mercifully) limited as well. In Wisconsin, the first $18,000 of a work comp claim falls into a ‘primary’ claim bucket and receives more weight than any additional money beyond that amount…so any single big claim will only hurt your mod so much.

How are EXPECTED claims calculated?

The estimate for expected claims is calculated using a few commonsense inputs. The rating bureau that calculates your mod looks at your organization’s payrolls split out by class code and then applies a multiplier for each class code depending on how risky the work for those employees has been historically statewide. For example, for every $100 of payroll your office workers might be expected to have $0.17 in claims, while a roofing contractor would be expected to have $18.26 per $100 of payroll. Some jobs are riskier than others.

Like with the actual claims value, the rating bureau breaks out your expected claims into a primary bucket and an excess bucket. The primary bucket picks up the initial portion of all claims and essentially measures claim frequency, and the excess bucket picks up any bigger claims…therefore measuring claim severity.

How can changes in the main inputs impact my mod?

This is the what-if portion of the article where you’ll see how different changes in key inputs impact the mod. Throughout this section I’ll be using a fictionalized manufacturing business.

Scenario #1: Our Baseline – 1.00

Our fictitious flooring company, Baseline Mfg., has an office of with several administrative employees, a sales team, and a team of employees on the floor with varying manufacturing roles and responsibilities.

Based on these details this company’s EXPECTED claims value is $52,000, and, because Baseline Mfg. is an average company, their ACTUAL claims value is $50,000. All these details together put their experience mod squarely at 1.00…which means their insurance premiums track the industry average.

Scenario #2: Improved Return-to-Work

As we’ve discussed, the rating bureaus provide big incentives for organizations to find ways to keep injured employees active during rehabilitation. In our baseline scenario Baseline Mfg. did a pretty good job of getting injured employees back to work, but there was room for improvement.

In this scenario, Baseline Mfg. has a robust return-to-work program, and over the historic three-year rating period they’ve avoided having a single claim with wage reimbursement or disability. No other changes have been made to the organization’s size, so the EXPECTED claims value has remained unchanged at $52,000. Employees are still getting injured at Baseline Mfg., but now their ACTUAL claims value has dropped substantially to $25,000. This reduction has resulted in the mod dropping all the way to 0.87. As you’ll recall, this means Baseline Mfg. is now enjoying a 13% credit (1.00 - 0.87 = 0.13) on the work comp premiums!

Scenario #3: One Catastrophic Claim

Sometimes accidents happen…and sometimes those accidents can be catastrophic. Fortunately, in these worst-case scenarios the work comp experience mod calculation has some built-in limits that blunt the impact of a catastrophic claim.

In this scenario, we’ll continue to assume the organization is unchanged in size, so the EXPECTED claims will remain $52,000. But now, instead of a handful of minor claims, Baseline Mfg. has had a single devastating claim in which an employee was in an accident and will now spend the rest of their life requiring round-the-clock care. The total cost of the medical payments, wage replacement and disability payments are well in excess of $1,000,000, but because there are caps on the experience mod calculation, the ACTUAL claim dollars that enter the formula are $250,000 with only $18,000 going into the ‘primary’ bucket.

In this scenario, the experience mod jumps from the baseline of 1.00 to 1.30…or a 30% increase in work comp premiums. Notably, without the caps that exist the mod could have been well over 2.50. How many organizations can afford to pay more than two times their current work comp premiums?

Scenario #4: Rapidly Increasing Payrolls

In our final scenario, we’ll return to our original 1.00 baseline numbers and will explore the impact that increasing the size of Baseline Mfg.’s payroll has on the experience mod. This time, we’ll assume that Baseline Mfg. has been able to increase its headcount – and therefore payroll – with both the sales and manufacturing teams while maintaining the same ACTUAL claims value of $50,000.

If payrolls climbed 50% with both Sales and Manufacturing the EXPECTED claims value would jump to something close to $66,000 (up from $52,000 in our original example). So, we had the EXPECTED claims number increase while the ACTUAL claims value stayed the same…which means the experience mod decreases. In this case the experience mod would drop to 0.93.

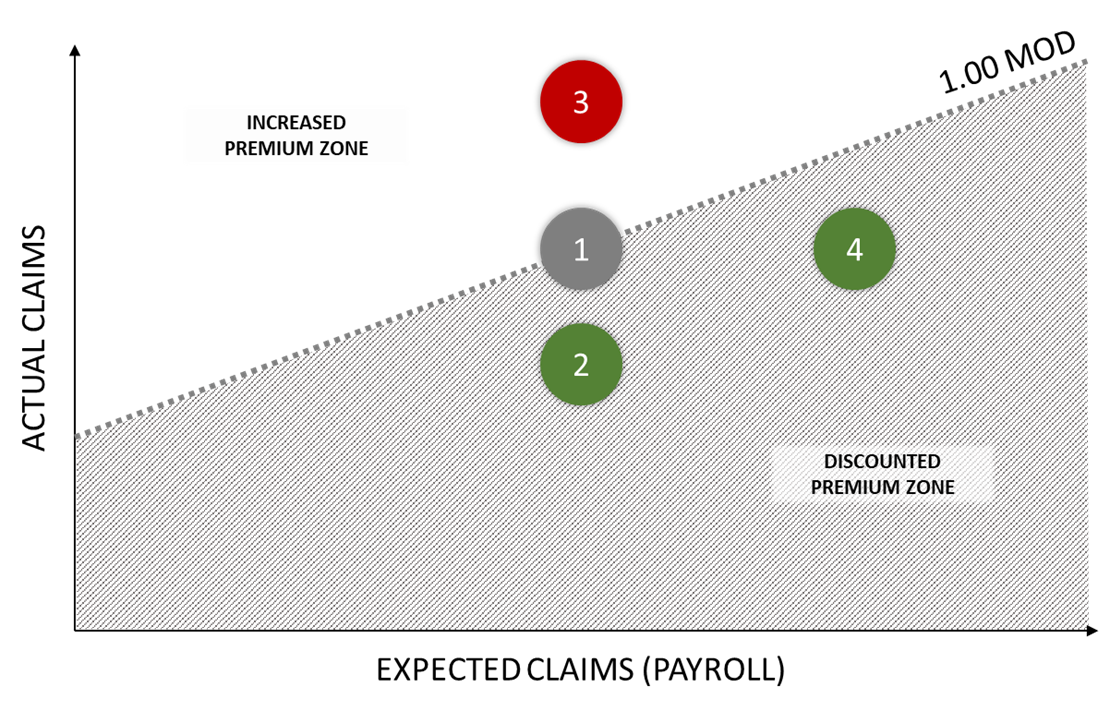

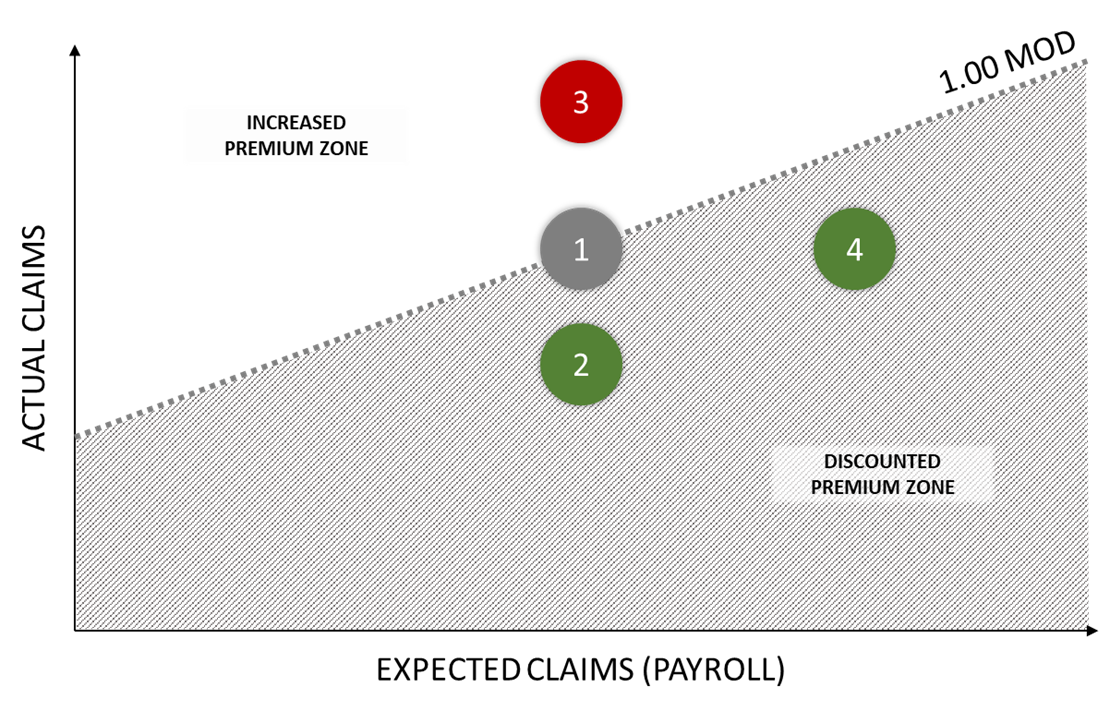

For the Visual Learners Out There

The graphic below shows each of our four scenarios as well as the relationship between payroll, claims and the experience mod. As your organization’s payroll climbs your EXPECTED claims value climbs. When you have more ACTUAL claims vs. EXPECTED claims your mod will be greater than 1.00 and you’ll pay increased work comp premiums.

Further reading

- The ABCs of Experience Rating – This is where I encourage everyone to start if they want to know more about their experience mod. You’ll get additional context without feeling totally overwhelmed.

This post is locked to comments.

This post is locked to comments.